2023 has seen some of the most significant changes to tax and family trust laws, and with 30 June 2023 approaching, we want to make sure you are aware of how these changes may affect you.

Big changes to tax laws and family trust laws in 2023

The last 12 months have seen some of the most significant changes to tax laws and laws affecting family trusts in decades. The information below is for taxpayers that either:

- are professional firms (a business offering customised, knowledge-based services to clients in a variety of professions which include, but are not limited to, accounting, architecture, engineering, financial services, law, medicine and management consulting) OR

- Operate, invest, trade, whether actively or passively, through the use of a discretionary (family) trust

If either or both apply to you, we strongly recommend you read on. If you do not operate or use a trust, or your business is not considered to be a ‘professional firm’, the below information is for your knowledge basis only.

Professional firm profits

PCG 2021/4 Allocation of professional firm profits: New guidance from the ATO that affects “professionals” and restricts the way they can spread their income across their family group. A PCG is not a tax ruling by the ATO. Instead, it is a guide about how the ATO wants to administer the tax laws and how the ATO will allocate their compliance resources (audit teams) according to their risk assessment concerning a transaction, a decision, or an arrangement.

This affects professional firms such as doctors, dentists, accountants, engineers, lawyers, architects, consultants, quantity surveyors and IT consultants. In addition, the ATO is concerned that the income earned by an individual professional practitioner (IPP) is not appropriately taxed to the IPP due to the IPP diverting the income to another entity or family member who pays a lower tax rate.

The ATO used PCG 2021/4 to outline three risk zones – green, amber and red. If you stay in the green zone, the ATO will be happy with your approach, and you will have the peace of mind that the ATO is unlikely to conduct any further review. If you move into the amber or red zones, it is highly likely that the ATO will audit you. The ATO expects a contemporaneously documented assessment of arrangements against the Guideline to be undertaken annually. IPPs must also review eligibility and reassess as the business or their arrangements change. This is a significant deviation from the ATO’s previous approach under the old guidelines and should not be taken lightly.

This is a highly complex area of tax law, and we therefore strongly recommend you consider a risk review of your current profit allocation arrangement. If you would like to discuss how we can assist you with this included additional advice on transitional arrangements to move into a lower risk zone category, or potential engagement with the ATO, please do not hesitate to ask.

Trust Distributions

S100A New Tax Rulings from the Australian Taxation Office (ATO) that may dramatically restrict how you can distribute profits from a Family Trust out to your family. In December 2022, the ATO released a finalised tax ruling (TR 2022/4) that completely changes the way that profits from Discretionary Trust (also known as a family trust) can be allocated among adult, children company beneficiaries, and loss entities based on S100A of the income tax assessment Act.

As a result of this tax ruling:

- Your options to spread your income across your family members and entities in your business group may be limited; and

- Your overall tax payable for your family group will probably increase.

Trust Distributions and consideration to all beneficiaries: Owie’s case. A recent decision in the Victorian Supreme Court of Appeal in Owies vs JJE Nominees Pty Ltd [2022] VSCA 142 (Owies case) has cast a new light on how much discretion a trustee has under a discretionary trust deed. A trustee has a fiduciary duty to all the Trust beneficiaries. In Owie’s case, the court confirmed that trustees could not simply do as they please, they “must give real and genuine consideration” to all the relevant circumstances when exercising their discretion. Although the Trust’s deed provided the trustee with “absolute and uncontrolled” discretion, the court of appeal found that the trustee had overstepped the bounds of its discretion. The distributions made for several years, as determined by the trustee, were found void, and the court even removed the trustee of the Trust.

The key takeaways from this case for trustees include the following:

- Trustees of discretionary family trust must give “real and genuine consideration” to all circumstances when exercising their power to appoint income of the trust estate to beneficiaries

- Where such a failure is severe enough, the trustee is at risk of being removed by the courts and replaced by an independent party

- Failure to give “real and genuine consideration” means that a court may declare those distributions void

Options for your 2023 trust distributions

To stay in the green zone and avoid ATO scrutiny, we recommend you consider the following trust distribution options for the 2023 financial year:

- Distribute all to Mum and Dad

- Continue to distribute to adult children and pay them within two years

- Distribute to adult children, who then make a personal superannuation contribution

- Charge adult children’s board, university, and other fees

- Proper use of a bucket company

- Make a once-off gift

We want to help you with our expert tax and accounting advice to navigate all these complex changes and make the lead-up to 30 June as smooth as possible. However, there are certain things we need to assist you with this year that need to occur in a specific order.

To make it easier for you, we have combined all the necessary actions we strongly recommend into the outline below.

Discretionary (family) trust distributions

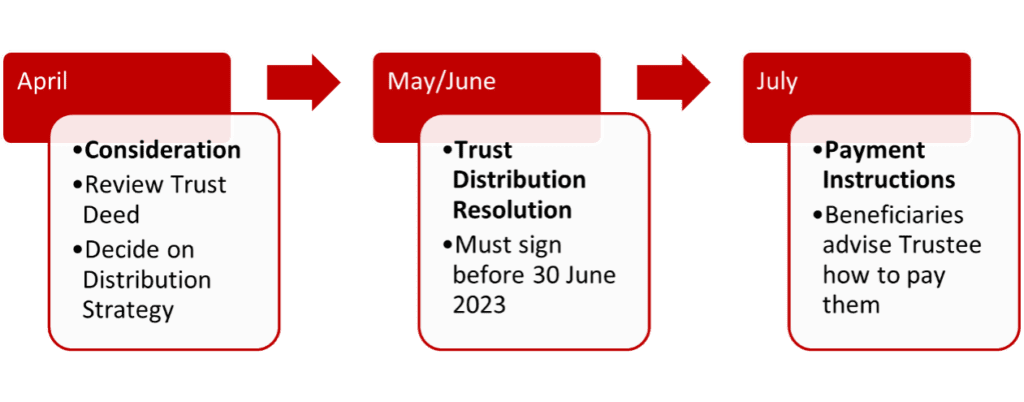

Here is the order of the critical services you will need over the coming months:

In April 2023, we will review your Trust Deed to let you know if you need to consider varying your Trust Deed to remove particular beneficiaries and therefore remove the risk of them forcing the trustee to pay Trust profits to them.

In June 2023, based on our Tax Planning Report to you we will prepare, under your instruction, a 2023 Trust Distribution Resolution for any Discretionary Trusts or Family Trusts you have. You must sign these before 30 June 2023, or the ATO may tax your Trust at the highest rate of 47% on any trust profits.

As part of our Trust Distribution Resolution document pack that we send you, we will also provide you with Payment Instructions that each Trust beneficiary can sign in the first week of July 2023. This new document for 2023 is needed to prove to the ATO that your Trust’s payments to beneficiaries are not part of what S100A of the tax legislation calls a “reimbursement agreement”, which can result in a tax of 47% being assessed on these Trust distributions.

Value to you

Family trust distributions

Our advice will ensure that:

- Your Trust Deed doesn’t expose you to beneficiaries forcing the trustee to pay them profits from your Trust.

- Your 2023 Trust Distributions will be signed before 30 June 2023 to avoid your Trust being taxed at 47% of its profits.

- You will have taken specific steps to make it difficult for the ATO to apply its new interpretation of S100A to your Trust and impose tax at 47% on certain Trust distributions.

Next steps

If you have further questions about the above issues or believe your business is impacted by the ATO’s new expectations for professional firm profits, contact us immediately to discuss how we can assist you.