One of the main tax events of the past month is the passing of a number of changes to taxation & small business. The key measures introduced are:

- 5% tax offset (capped at a maximum of $1,000 per income year) to individuals who run small businesses with an aggregate annual turnover of less than $2m, or who have a share of a small business’ income included in their assessable income (i.e. through trust distributions)

- Small businesses and individuals will be able to immediately deduct certain costs incurred when starting up a business

- An extension of the FBT exemption that applies to employers that are providing employees with work-related portable electronic devices. The rules allow multiple portable electronic devices to be provided to employees without tax consequences where those devices are to be primarily used for business purposes.

In other news, the ATO has also increased the hourly rate for deducting home office expenses from 34 cents per hour to 45 cents for hour applicable from 1 July 2014. In 2001 the ATO released a practice statement that confirmed that the running costs of a home office comprising electricity, gas and decline in value of office furniture can either be claimed using the actual value or at the determined hourly rate. This is a welcome change amid ever-increasing cost of utilities. After more than 50 years of being able to claim some form of tax concession for medical expenses, the 2016 financial year marks the final stage of the phase-out of medical expenses tax offset. From 1 July 2016, taxpayers can only claim the medical expenses rebate for medical expenses relating to disability aids, attendant care or aged care, regardless of whether they have received the medical expenses rebate in the previous two income years. This rebate will be available until the end of the 2018/19 income tax year.

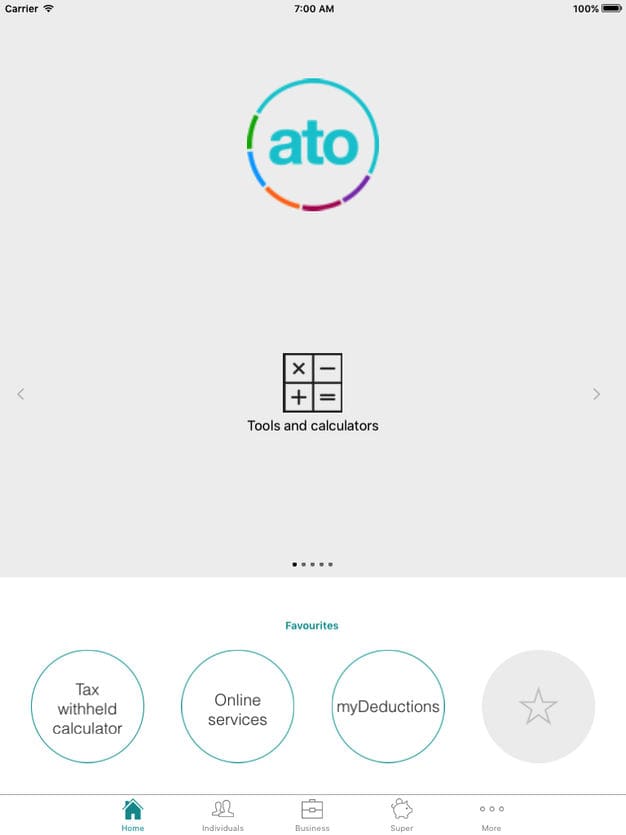

Finally, in June 2015 the ATO announced the release of the myDeductions app. The app records, classifies, and stores work-related deductions data, including vehicle expenses. The app allows you to save photos of invoices and receipts, which are sufficient evidence for claiming deductions according to a ruling released by the ATO. deductions are available on iTunes, Play Store or windows phone store and is an added feature of the newly redesigned ATO app. We look forward to our client ditching their shoeboxes of receipts in favour of the one electronic file!